Introduction

Harry Browne was an influencial politician, financial advisor, and author who lived from 1933 to 2006 and published 12 books. Wikipedia has an in-depth biography on him.

Within the world of finance and investing, one of his best known works is Fail-Safe Investing: Lifelong Financial Security in 30 Minutes. In it, he introduces the idea of the “Permanent Portfolio”, an investment strategy that uses only four assets and is very simple to implement.

In this post, we will investigate Browne’s suggested portfolio, including performance across various market cycles and economic regimes.

Browne’s Portfolio Requirements

In Fail-Safe Investing, under rule #11, Browne lays out the requirements for a “bulletproof portfolio” that will “assure that your wealth will survive any event - including events that would be devastating to any one investment. In other words, this portfolio should protect you no matter what the future brings.”

His requirements for the portfolio consist of the followng:

- Safety: Protection again any economic future, including “inflation, recession, or even depression”

- Stability: Performance should be consistent so that you will not need to make any changes and will not experience significant drawdowns

- Simplicity: Easy to implement and take very little time to maintain

He then describes the four “broad movements” of the economy:

- Prosperity: The economy is growing, business is doing well, interest rates are usually low

- Inflation: The cost of goods and services is rising

- Tight money or recession: The money supply is shrinking, economic activity is slowing

- Deflation: Prices are declining and the value of money is increasing

The Permanent Portfolio

Browne then matches an asset class to each of the economic conditions above:

- Prosperity -> Stocks (due to prosperity) and long term bonds (when interest rates fall)

- Inflation -> Gold

- Deflation -> Long term bonds (when interest rates fall)

- Tight money -> Cash

He completes the Permanent Portfolio by stipulating the following:

- Start with a base allocation of 25% to each of the asset classes (stocks, bonds, gold, cash)

- Rebalance back to the base allocation annually, or when “any of the four investments has become worth less than 15%, or more than 35%, of the portfolio’s overall value”Note: Browne does not specify when the portfolio should be rebalanced; therefore, we will make an assumption of a January 1st rebalance.

Data

For this exercise, we will use the following asset classes:

- Stocks: S&P 500 (SPXT_S&P 500 Total Return Index)

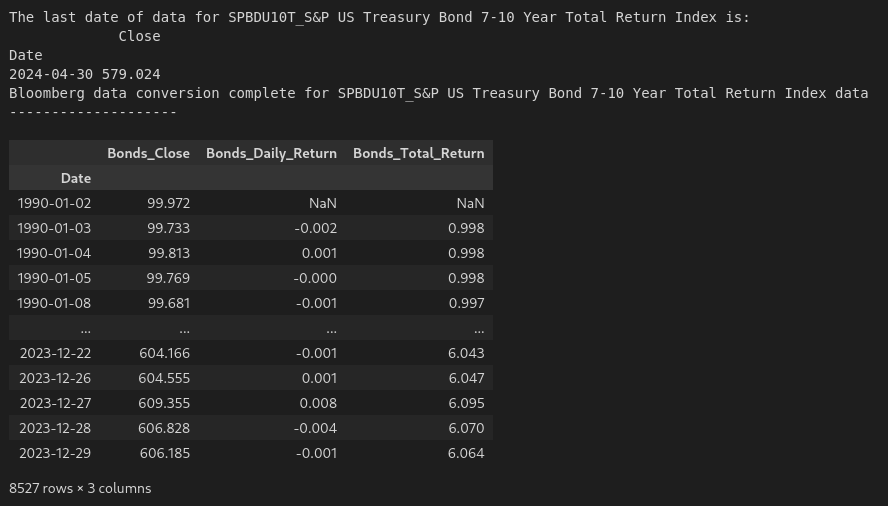

- Bonds: 10 Year US Treasuries (SPBDU10T_S&P US Treasury Bond 7-10 Year Total Return Index)

- Gold: Gold Spot Price (XAU_Gold USD Spot)

- Cash: USD

With the exception of cash, all data is sourced from Bloomberg.

We could use ETFs, but the available price history for the ETFs is much shorter than the indices above. If we wanted to use ETFs, the following would work:

- Stocks: IVV - iShares Core S&P 500 ETF

- Bonds: IEF - iShares 7-10 Year Treasury Bond ETF

- Gold: GLD - SPDR Gold Shares ETF

- Cash: USD

Python Functions

First, a couple of useful python functions to help with the analysis.

Clean Bloomberg Data Export

This is discussed here.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

|

# This function takes an excel export from Bloomberg and

# removes all excess data leaving date and close columns

# Imports

import pandas as pd

# Function definition

def bb_data_updater(fund):

# File name variable

file = fund + ".xlsx"

# Import data from file as a pandas dataframe

df = pd.read_excel(file, sheet_name = 'Worksheet', engine='openpyxl')

# Set the column headings from row 5 (which is physically row 6)

df.columns = df.iloc[5]

# Set the column heading for the index to be "None"

df.rename_axis(None, axis=1, inplace = True)

# Drop the first 6 rows, 0 - 5

df.drop(df.index[0:6], inplace=True)

# Set the date column as the index

df.set_index('Date', inplace = True)

# Drop the volume column

try:

df.drop(columns = {'PX_VOLUME'}, inplace = True)

except KeyError:

pass

# Rename column

df.rename(columns = {'PX_LAST':'Close'}, inplace = True)

# Sort by date

df.sort_values(by=['Date'], inplace = True)

# Export data to excel

file = fund + "_Clean.xlsx"

df.to_excel(file, sheet_name='data')

# Output confirmation

print(f"The last date of data for {fund} is: ")

print(df[-1:])

print(f"Bloomberg data conversion complete for {fund} data")

return print(f"--------------------")

|

Set Number Of Decimal Places

1

2

3

4

|

# Set number of decimal places in pandas

def dp(decimal_places):

pd.set_option('display.float_format', lambda x: f'%.{decimal_places}f' % x)

|

1

2

3

4

5

6

7

8

9

10

11

|

# The `df_info` function returns some useful information about

# a dataframe, such as the columns, data types, and size.

def df_info(df):

print('There are ', df.shape[0], ' rows and ', df.shape[1], ' columns')

print('The columns and data types are:')

print(df.dtypes)

print('The first 4 rows are:')

display(df.head(4))

print('The last 4 rows are:')

display(df.tail(4))

|

Import Data From CSV / XLSX

1

2

3

4

5

6

7

8

9

10

11

12

13

14

|

def load_data(file):

# Import CSV

try:

df = pd.read_csv(file)

except:

pass

# Import excel

try:

df = pd.read_excel(file, sheet_name='data', engine='openpyxl')

except:

pass

return df

|

Portfolio Strategy

This is the function that executes the strategy. That is, takes in the following variables and produces a dataframe with the results:

- fund_list: This is a list of the funds (in this case asset classes) to be used

- starting_cash: Starting capital amount for the strategy

- cash_contrib: Daily cash contribution

- close_prices_df; Dataframe with close prices for each asset class

- rebal_month: Month that the annual rebalancing should take place

- rebal_day: Day of the month that the annual rebalancing should take place

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

|

def strategy(fund_list, starting_cash, cash_contrib, close_prices_df, rebal_month, rebal_day, rebal_per_high, rebal_per_low):

num_funds = len(fund_list)

df = close_prices_df.copy()

df.reset_index(inplace = True)

# Date to be used for annual rebalance

target_month = rebal_month

target_day = rebal_day

# Create a dataframe with dates from the specific month

rebal_date = df[df['Date'].dt.month == target_month]

# Specify the date or the next closest

rebal_date = rebal_date[rebal_date['Date'].dt.day >= target_day]

# Group by year and take the first entry for each year

rebal_dates_by_year = rebal_date.groupby(rebal_date['Date'].dt.year).first().reset_index(drop=True)

'''

Column order for the dataframe:

df[fund + "_BA_Shares"]

df[fund + "_BA_$_Invested"]

df[fund + "_BA_Port_%"]

df['Total_BA_$_Invested']

df['Contribution']

df['Rebalance']

df[fund + "_AA_Shares"]

df[fund + "_AA_$_Invested"]

df[fund + "_AA_Port_%"]

df['Total_AA_$_Invested']

'''

# Calculate the columns and initial values for before action (BA) shares, $ invested, and port %

for fund in fund_list:

df[fund + "_BA_Shares"] = starting_cash / num_funds / df[fund + "_Close"]

df[fund + "_BA_$_Invested"] = df[fund + "_BA_Shares"] * df[fund + "_Close"]

df[fund + "_BA_Port_%"] = 0.25

# Set column values initially

df['Total_BA_$_Invested'] = starting_cash

df['Contribution'] = 0

# df['Contribution'] = cash_contrib

df['Rebalance'] = "No"

# Set columns and values initially for after action (AA) shares, $ invested, and port %

for fund in fund_list:

df[fund + "_AA_Shares"] = starting_cash / num_funds / df[fund + "_Close"]

df[fund + "_AA_$_Invested"] = df[fund + "_AA_Shares"] * df[fund + "_Close"]

df[fund + "_AA_Port_%"] = 0.25

# Set column value for after action (AA) total $ invested

df['Total_AA_$_Invested'] = starting_cash

# Iterate through the dataframe and execute the strategy

for index, row in df.iterrows():

# Ensure there's a previous row to reference by checking the index value

if index > 0:

# Initialize variable

Total_BA_Invested = 0

# Calculate before action (BA) shares and $ invested values

for fund in fund_list:

df.at[index, fund + "_BA_Shares"] = df.at[index - 1, fund + "_AA_Shares"]

df.at[index, fund + "_BA_$_Invested"] = df.at[index, fund + "_BA_Shares"] * row[fund + "_Close"]

# Sum the asset values to find the total

Total_BA_Invested = Total_BA_Invested + df.at[index, fund + "_BA_$_Invested"]

# Calculate before action (BA) port % values

for fund in fund_list:

df.at[index, fund + "_BA_Port_%"] = df.at[index, fund + "_BA_$_Invested"] / Total_BA_Invested

# Set column for before action (BA) total $ invested

df.at[index, 'Total_BA_$_Invested'] = Total_BA_Invested

# Initialize variables

rebalance = "No"

date = row['Date']

# Check for a specific date annually

# Simple if statement to check if date_to_check is in jan_28_or_after_each_year

if date in rebal_dates_by_year['Date'].values:

rebalance = "Yes"

else:

pass

# Check to see if any asset has portfolio percentage of greater than 35% or less than 15% and if so set variable

for fund in fund_list:

if df.at[index, fund + "_BA_Port_%"] > rebal_per_high or df.at[index, fund + "_BA_Port_%"] < rebal_per_low:

rebalance = "Yes"

else:

pass

# If rebalance is required, rebalance back to 25% for each asset, else just divide contribution evenly across assets

if rebalance == "Yes":

df.at[index, 'Rebalance'] = rebalance

for fund in fund_list:

df.at[index, fund + "_AA_$_Invested"] = (Total_BA_Invested + df.at[index, 'Contribution']) * 0.25

else:

df.at[index, 'Rebalance'] = rebalance

for fund in fund_list:

df.at[index, fund + "_AA_$_Invested"] = df.at[index, fund + "_BA_$_Invested"] + df.at[index, 'Contribution'] * 0.25

# Initialize variable

Total_AA_Invested = 0

# Set column values for after action (AA) shares and port %

for fund in fund_list:

df.at[index, fund + "_AA_Shares"] = df.at[index, fund + "_AA_$_Invested"] / row[fund + "_Close"]

# Sum the asset values to find the total

Total_AA_Invested = Total_AA_Invested + df.at[index, fund + "_AA_$_Invested"]

# Calculate after action (AA) port % values

for fund in fund_list:

df.at[index, fund + "_AA_Port_%"] = df.at[index, fund + "_AA_$_Invested"] / Total_AA_Invested

# Set column for after action (AA) total $ invested

df.at[index, 'Total_AA_$_Invested'] = Total_AA_Invested

# If this is the first row

else:

pass

df['Return'] = df['Total_AA_$_Invested'].pct_change()

df['Cumulative_Return'] = (1 + df['Return']).cumprod()

plan_name = '_'.join(fund_list)

file = plan_name + "_Strategy.xlsx"

location = file

df.to_excel(location, sheet_name='data')

print(f"Strategy complete for {plan_name}.")

return df

|

Summary Stats

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

|

# stats for entire data set

def summary_stats(fund_list, df, period):

if period == 'Monthly':

timeframe = 12 # months

df_stats = pd.DataFrame(df.mean(axis=0) * timeframe) # annualized

df_stats.columns = ['Annualized Mean']

df_stats['Annualized Volatility'] = df.std() * np.sqrt(timeframe) # annualized

df_stats['Annualized Sharpe Ratio'] = df_stats['Annualized Mean'] / df_stats['Annualized Volatility']

df_cagr = (1 + df['Return']).cumprod()

cagr = (df_cagr[-1] / 1) ** (1/(len(df_cagr) / timeframe)) - 1

df_stats['CAGR'] = cagr

df_stats[period + ' Max Return'] = df.max()

df_stats[period + ' Max Return (Date)'] = df.idxmax().values[0]

df_stats[period + ' Min Return'] = df.min()

df_stats[period + ' Min Return (Date)'] = df.idxmin().values[0]

wealth_index = 1000*(1+df).cumprod()

previous_peaks = wealth_index.cummax()

drawdowns = (wealth_index - previous_peaks)/previous_peaks

df_stats['Max Drawdown'] = drawdowns.min()

df_stats['Peak'] = [previous_peaks[col][:drawdowns[col].idxmin()].idxmax() for col in previous_peaks.columns]

df_stats['Bottom'] = drawdowns.idxmin()

recovery_date = []

for col in wealth_index.columns:

prev_max = previous_peaks[col][:drawdowns[col].idxmin()].max()

recovery_wealth = pd.DataFrame([wealth_index[col][drawdowns[col].idxmin():]]).T

recovery_date.append(recovery_wealth[recovery_wealth[col] >= prev_max].index.min())

df_stats['Recovery Date'] = recovery_date

plan_name = '_'.join(fund_list)

file = plan_name + "_Summary_Stats.xlsx"

location = file

df_stats.to_excel(location, sheet_name='data')

print(f"Summary stats complete for {plan_name}.")

return df_stats

elif period == 'Weekly':

timeframe = 52 # weeks

df_stats = pd.DataFrame(df.mean(axis=0) * timeframe) # annualized

df_stats.columns = ['Annualized Mean']

df_stats['Annualized Volatility'] = df.std() * np.sqrt(timeframe) # annualized

df_stats['Annualized Sharpe Ratio'] = df_stats['Annualized Mean'] / df_stats['Annualized Volatility']

df_cagr = (1 + df['Return']).cumprod()

cagr = (df_cagr[-1] / 1) ** (1/(len(df_cagr) / timeframe)) - 1

df_stats['CAGR'] = cagr

df_stats[period + ' Max Return'] = df.max()

df_stats[period + ' Max Return (Date)'] = df.idxmax().values[0]

df_stats[period + ' Min Return'] = df.min()

df_stats[period + ' Min Return (Date)'] = df.idxmin().values[0]

wealth_index = 1000*(1+df).cumprod()

previous_peaks = wealth_index.cummax()

drawdowns = (wealth_index - previous_peaks)/previous_peaks

df_stats['Max Drawdown'] = drawdowns.min()

df_stats['Peak'] = [previous_peaks[col][:drawdowns[col].idxmin()].idxmax() for col in previous_peaks.columns]

df_stats['Bottom'] = drawdowns.idxmin()

recovery_date = []

for col in wealth_index.columns:

prev_max = previous_peaks[col][:drawdowns[col].idxmin()].max()

recovery_wealth = pd.DataFrame([wealth_index[col][drawdowns[col].idxmin():]]).T

recovery_date.append(recovery_wealth[recovery_wealth[col] >= prev_max].index.min())

df_stats['Recovery Date'] = recovery_date

plan_name = '_'.join(fund_list)

file = plan_name + "_Summary_Stats.xlsx"

location = file

df_stats.to_excel(location, sheet_name='data')

print(f"Summary stats complete for {plan_name}.")

return df_stats

elif period == 'Daily':

timeframe = 365 # days

df_stats = pd.DataFrame(df.mean(axis=0) * timeframe) # annualized

df_stats.columns = ['Annualized Mean']

df_stats['Annualized Volatility'] = df.std() * np.sqrt(timeframe) # annualized

df_stats['Annualized Sharpe Ratio'] = df_stats['Annualized Mean'] / df_stats['Annualized Volatility']

df_cagr = (1 + df['Return']).cumprod()

cagr = (df_cagr[-1] / 1) ** (1/(len(df_cagr) / timeframe)) - 1

df_stats['CAGR'] = cagr

df_stats[period + ' Max Return'] = df.max()

df_stats[period + ' Max Return (Date)'] = df.idxmax().values[0]

df_stats[period + ' Min Return'] = df.min()

df_stats[period + ' Min Return (Date)'] = df.idxmin().values[0]

wealth_index = 1000*(1+df).cumprod()

previous_peaks = wealth_index.cummax()

drawdowns = (wealth_index - previous_peaks)/previous_peaks

df_stats['Max Drawdown'] = drawdowns.min()

df_stats['Peak'] = [previous_peaks[col][:drawdowns[col].idxmin()].idxmax() for col in previous_peaks.columns]

df_stats['Bottom'] = drawdowns.idxmin()

recovery_date = []

for col in wealth_index.columns:

prev_max = previous_peaks[col][:drawdowns[col].idxmin()].max()

recovery_wealth = pd.DataFrame([wealth_index[col][drawdowns[col].idxmin():]]).T

recovery_date.append(recovery_wealth[recovery_wealth[col] >= prev_max].index.min())

df_stats['Recovery Date'] = recovery_date

plan_name = '_'.join(fund_list)

file = plan_name + "_Summary_Stats.xlsx"

location = file

df_stats.to_excel(location, sheet_name='data')

print(f"Summary stats complete for {plan_name}.")

return df_stats

else:

return print("Error, check inputs")

|

Plot Cumulative Return

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

|

def plot_cumulative_return(strat_df):

# Generate plot

plt.figure(figsize=(10, 5), facecolor = '#F5F5F5')

# Plotting data

plt.plot(strat_df.index, strat_df['Cumulative_Return'], label = 'Strategy Cumulative Return', linestyle='-', color='green', linewidth=1)

# Set X axis

# x_tick_spacing = 5 # Specify the interval for x-axis ticks

# plt.gca().xaxis.set_major_locator(MultipleLocator(x_tick_spacing))

plt.gca().xaxis.set_major_locator(mdates.YearLocator())

plt.gca().xaxis.set_major_formatter(mdates.DateFormatter('%Y'))

plt.xlabel('Year', fontsize = 9)

plt.xticks(rotation = 45, fontsize = 7)

# plt.xlim(, )

# Set Y axis

y_tick_spacing = 0.5 # Specify the interval for y-axis ticks

plt.gca().yaxis.set_major_locator(MultipleLocator(y_tick_spacing))

plt.ylabel('Cumulative Return', fontsize = 9)

plt.yticks(fontsize = 7)

plt.ylim(0, 7.5)

# Set title, etc.

plt.title('Cumulative Return', fontsize = 12)

# Set the grid & legend

plt.tight_layout()

plt.grid(True)

plt.legend(fontsize=8)

# Save the figure

plt.savefig('03_Cumulative_Return.png', dpi=300, bbox_inches='tight')

# Display the plot

return plt.show()

|

Plot Portfolio Values

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

|

def plot_values(strat_df):

# Generate plot

plt.figure(figsize=(10, 5), facecolor = '#F5F5F5')

# Plotting data

plt.plot(strat_df.index, strat_df['Total_AA_$_Invested'], label='Total Portfolio Value', linestyle='-', color='black', linewidth=1)

plt.plot(strat_df.index, strat_df['Stocks_AA_$_Invested'], label='Stocks Position Value', linestyle='-', color='orange', linewidth=1)

plt.plot(strat_df.index, strat_df['Bonds_AA_$_Invested'], label='Bond Position Value', linestyle='-', color='yellow', linewidth=1)

plt.plot(strat_df.index, strat_df['Gold_AA_$_Invested'], label='Gold Position Value', linestyle='-', color='blue', linewidth=1)

plt.plot(strat_df.index, strat_df['Cash_AA_$_Invested'], label='Cash Position Value', linestyle='-', color='brown', linewidth=1)

# Set X axis

# x_tick_spacing = 5 # Specify the interval for x-axis ticks

# plt.gca().xaxis.set_major_locator(MultipleLocator(x_tick_spacing))

plt.gca().xaxis.set_major_locator(mdates.YearLocator())

plt.gca().xaxis.set_major_formatter(mdates.DateFormatter('%Y'))

plt.xlabel('Year', fontsize = 9)

plt.xticks(rotation = 45, fontsize = 7)

# plt.xlim(, )

# Set Y axis

y_tick_spacing = 5000 # Specify the interval for y-axis ticks

plt.gca().yaxis.set_major_locator(MultipleLocator(y_tick_spacing))

plt.gca().yaxis.set_major_formatter(mtick.FuncFormatter(lambda x, pos: '{:,.0f}'.format(x))) # Adding commas to y-axis labels

plt.ylabel('Total Value ($)', fontsize = 9)

plt.yticks(fontsize = 7)

plt.ylim(0, 75000)

# Set title, etc.

plt.title('Total Values For Stocks, Bonds, Gold, and Cash Positions and Portfolio', fontsize = 12)

# Set the grid & legend

plt.tight_layout()

plt.grid(True)

plt.legend(fontsize=8)

# Save the figure

plt.savefig('04_Portfolio_Values.png', dpi=300, bbox_inches='tight')

# Display the plot

return plt.show()

|

Plot Portfolio Drawdown

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

|

def plot_drawdown(strat_df):

rolling_max = strat_df['Total_AA_$_Invested'].cummax()

drawdown = (strat_df['Total_AA_$_Invested'] - rolling_max) / rolling_max * 100

# Generate plot

plt.figure(figsize=(10, 5), facecolor = '#F5F5F5')

# Plotting data

plt.plot(strat_df.index, drawdown, label='Drawdown', linestyle='-', color='red', linewidth=1)

# Set X axis

# x_tick_spacing = 5 # Specify the interval for x-axis ticks

# plt.gca().xaxis.set_major_locator(MultipleLocator(x_tick_spacing))

plt.gca().xaxis.set_major_locator(mdates.YearLocator())

plt.gca().xaxis.set_major_formatter(mdates.DateFormatter('%Y'))

plt.xlabel('Year', fontsize = 9)

plt.xticks(rotation = 45, fontsize = 7)

# plt.xlim(, )

# Set Y axis

y_tick_spacing = 1 # Specify the interval for y-axis ticks

plt.gca().yaxis.set_major_locator(MultipleLocator(y_tick_spacing))

# plt.gca().yaxis.set_major_formatter(mtick.FuncFormatter(lambda x, pos: '{:,.0f}'.format(x))) # Adding commas to y-axis labels

plt.gca().yaxis.set_major_formatter(mtick.FuncFormatter(lambda x, pos: '{:.0f}'.format(x))) # Adding 0 decimal places to y-axis labels

plt.ylabel('Drawdown (%)', fontsize = 9)

plt.yticks(fontsize = 7)

plt.ylim(-20, 0)

# Set title, etc.

plt.title('Portfolio Drawdown', fontsize = 12)

# Set the grid & legend

plt.tight_layout()

plt.grid(True)

plt.legend(fontsize=8)

# Save the figure

plt.savefig('05_Portfolio_Drawdown.png', dpi=300, bbox_inches='tight')

# Display the plot

return plt.show()

|

Plot Portfolio Asset Weights

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

|

def plot_asset_weights(strat_df):

# Generate plot

plt.figure(figsize=(10, 5), facecolor = '#F5F5F5')

# Plotting data

plt.plot(strat_df.index, strat_df['Stocks_AA_Port_%'] * 100, label='Stocks Portfolio Weight', linestyle='-', color='orange', linewidth=1)

plt.plot(strat_df.index, strat_df['Bonds_AA_Port_%'] * 100, label='Bonds Portfolio Weight', linestyle='-', color='yellow', linewidth=1)

plt.plot(strat_df.index, strat_df['Gold_AA_Port_%'] * 100, label='Gold Portfolio Weight', linestyle='-', color='blue', linewidth=1)

plt.plot(strat_df.index, strat_df['Cash_AA_Port_%'] * 100, label='Cash Portfolio Weight', linestyle='-', color='brown', linewidth=1)

# Set X axis

# x_tick_spacing = 5 # Specify the interval for x-axis ticks

# plt.gca().xaxis.set_major_locator(MultipleLocator(x_tick_spacing))

plt.gca().xaxis.set_major_locator(mdates.YearLocator())

plt.gca().xaxis.set_major_formatter(mdates.DateFormatter('%Y'))

plt.xlabel('Year', fontsize = 9)

plt.xticks(rotation = 45, fontsize = 7)

# plt.xlim(, )

# Set Y axis

y_tick_spacing = 2 # Specify the interval for y-axis ticks

plt.gca().yaxis.set_major_locator(MultipleLocator(y_tick_spacing))

# plt.gca().yaxis.set_major_formatter(mtick.FuncFormatter(lambda x, pos: '{:,.0f}'.format(x))) # Adding commas to y-axis labels

plt.ylabel('Asset Weight (%)', fontsize = 9)

plt.yticks(fontsize = 7)

plt.ylim(14, 36)

# Set title, etc.

plt.title('Portfolio Asset Weights For Stocks, Bonds, Gold, and Cash Positions', fontsize = 12)

# Set the grid & legend

plt.tight_layout()

plt.grid(True)

plt.legend(fontsize=8)

# Save the figure

plt.savefig('07_Portfolio_Weights.png', dpi=300, bbox_inches='tight')

# Display the plot

return plt.show()

|

Data Overview

Import Data

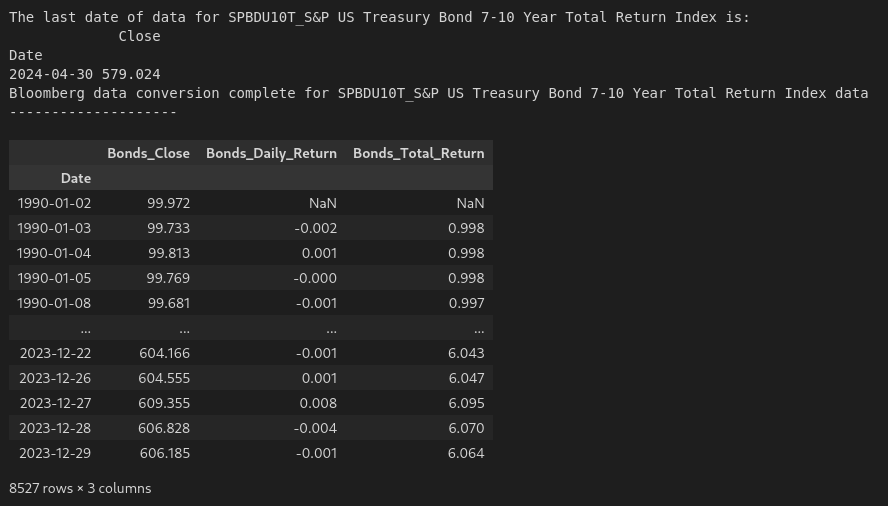

As previously mentioned, the data for this exercise comes primarily from Bloomberg. We’ll start with loading the data first for bonds:

1

2

3

4

5

6

7

8

9

10

|

# Bonds dataframe

bb_data_updater('SPBDU10T_S&P US Treasury Bond 7-10 Year Total Return Index')

bonds_data = load_data('SPBDU10T_S&P US Treasury Bond 7-10 Year Total Return Index_Clean.xlsx')

bonds_data['Date'] = pd.to_datetime(bonds_data['Date'])

bonds_data.set_index('Date', inplace = True)

bonds_data = bonds_data[(bonds_data.index >= '1990-01-01') & (bonds_data.index <= '2023-12-31')]

bonds_data.rename(columns={'Close':'Bonds_Close'}, inplace=True)

bonds_data['Bonds_Daily_Return'] = bonds_data['Bonds_Close'].pct_change()

bonds_data['Bonds_Total_Return'] = (1 + bonds_data['Bonds_Daily_Return']).cumprod()

bonds_data

|

The following is the output:

Then for stocks:

1

2

3

4

5

6

7

8

9

10

|

# Stocks dataframe

bb_data_updater('SPXT_S&P 500 Total Return Index')

stocks_data = load_data('SPXT_S&P 500 Total Return Index_Clean.xlsx')

stocks_data['Date'] = pd.to_datetime(stocks_data['Date'])

stocks_data.set_index('Date', inplace = True)

stocks_data = stocks_data[(stocks_data.index >= '1990-01-01') & (stocks_data.index <= '2023-12-31')]

stocks_data.rename(columns={'Close':'Stocks_Close'}, inplace=True)

stocks_data['Stocks_Daily_Return'] = stocks_data['Stocks_Close'].pct_change()

stocks_data['Stocks_Total_Return'] = (1 + stocks_data['Stocks_Daily_Return']).cumprod()

stocks_data

|

And finally, gold:

1

2

3

4

5

6

7

8

9

10

|

# Gold dataframe

bb_data_updater('XAU_Gold USD Spot')

gold_data = load_data('XAU_Gold USD Spot_Clean.xlsx')

gold_data['Date'] = pd.to_datetime(gold_data['Date'])

gold_data.set_index('Date', inplace = True)

gold_data = gold_data[(gold_data.index >= '1990-01-01') & (gold_data.index <= '2023-12-31')]

gold_data.rename(columns={'Close':'Gold_Close'}, inplace=True)

gold_data['Gold_Daily_Return'] = gold_data['Gold_Close'].pct_change()

gold_data['Gold_Total_Return'] = (1 + gold_data['Gold_Daily_Return']).cumprod()

gold_data

|

Combine Data

We’ll now combine the dataframes for the timeseries data from each of the asset classes, as follows:

1

2

3

4

5

|

perm_port = pd.merge(stocks_data['Stocks_Close'], bonds_data['Bonds_Close'], left_index=True, right_index=True)

perm_port = pd.merge(perm_port, gold_data['Gold_Close'], left_index=True, right_index=True)

perm_port['Cash_Close'] = 1

perm_port.dropna(inplace=True)

perm_port

|

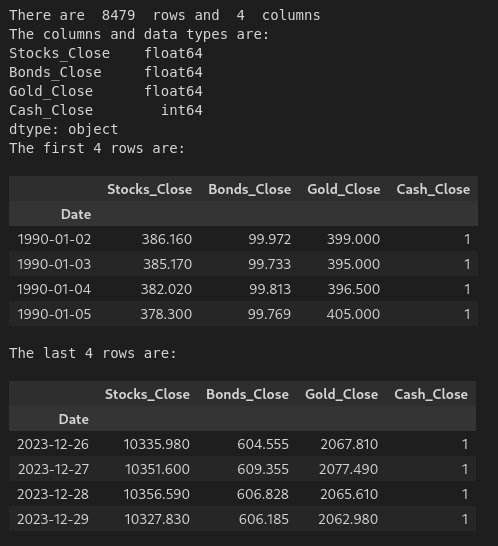

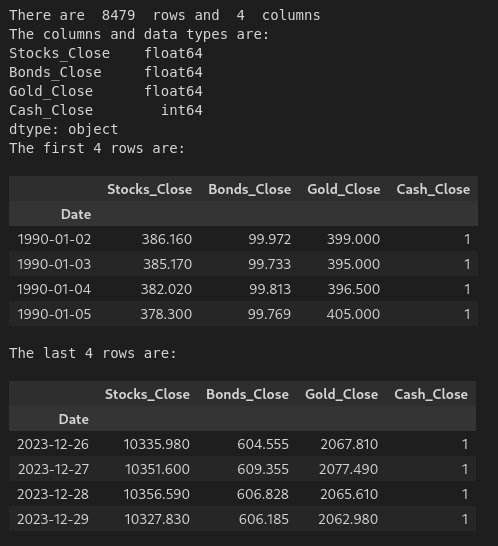

DataFrame Info

Now, running:

Gives us the following:

We can see that we have close data for all 4 asset classes from the beginning of 1990 to the end of 2023.

Execute Strategy

Using an annual rebalance date of January 1, we’ll now execute the strategy with the following code:

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

|

# List of funds to be used

fund_list = ['Stocks', 'Bonds', 'Gold', 'Cash']

# Starting cash contribution

starting_cash = 10000

# Monthly cash contribution

cash_contrib = 0

strat = strategy(fund_list, starting_cash, cash_contrib, perm_port, 1, 1, 0.35, 0.15).set_index('Date')

sum_stats = summary_stats(fund_list, strat[['Return']], 'Daily')

display(sum_stats)

strat_pre_1999 = strat[strat.index < '2000-01-01']

sum_stats_pre_1999 = summary_stats(fund_list, strat_pre_1999[['Return']], 'Daily')

display(sum_stats_pre_1999)

strat_post_1999 = strat[strat.index >= '2000-01-01']

sum_stats_post_1999 = summary_stats(fund_list, strat_post_1999[['Return']], 'Daily')

display(sum_stats_post_1999)

plot_cumulative_return(strat)

plot_values(strat)

plot_drawdown(strat)

plot_asset_weights(strat)

strat_annual_returns = strat['Cumulative_Return'].resample('Y').last().pct_change().dropna()

strat_annual_returns_df = strat_annual_returns.to_frame()

strat_annual_returns_df['Year'] = strat_annual_returns_df.index.year # Add a 'Year' column with just the year

strat_annual_returns_df.reset_index(drop=True, inplace=True) # Reset the index to remove the datetime index

# Now, the DataFrame will have 'Year' and 'Cumulative_Return' columns

strat_annual_returns_df = strat_annual_returns_df[['Year', 'Cumulative_Return']] # Keep only 'Year' and 'Cumulative_Return' columns

strat_annual_returns_df.rename(columns = {'Cumulative_Return':'Return'}, inplace=True)

strat_annual_returns_df.set_index('Year', inplace=True)

strat_annual_returns_df

# display(strat_annual_returns_df)

plan_name = '_'.join(fund_list)

file = plan_name + "_Annual_Returns.xlsx"

location = file

strat_annual_returns_df.to_excel(location, sheet_name='data')

plot_annual_returns(strat_annual_returns_df)

|

Since the strategy, summary statistics, and annual returns are all exported as excel files, they can be found at the following locations:

Stocks_Bonds_Gold_Cash_Strategy.xlsx

Stocks_Bonds_Gold_Cash_Summary_Stats.xlsx

Stocks_Bonds_Gold_Cash_Annual_Returns.xlsx

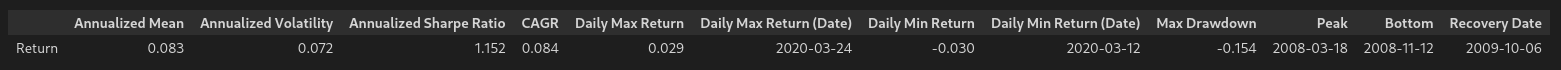

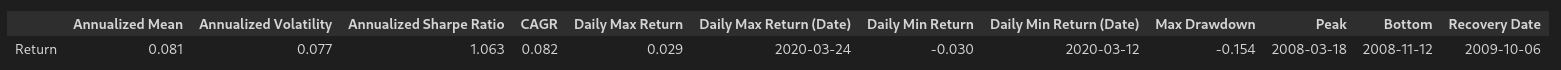

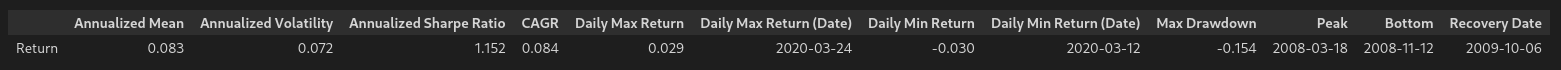

Here’s the summary stats for the example above:

Here we have a mean annualized return of 8.3%, volatility of 7.2%, a CAGR of 8.4% and a Sharpe ratio of 1.15. And this with a max drawdown of just over 15%. Not bad, Mr. Browne!

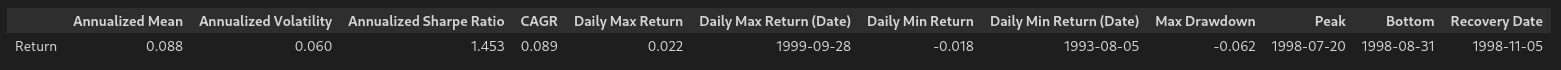

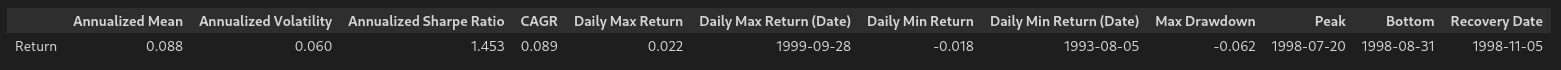

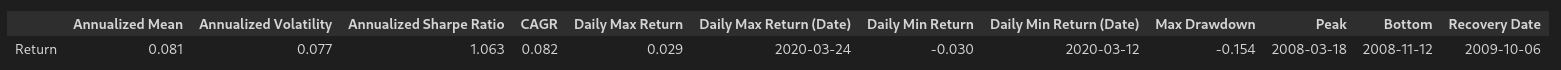

Since the book was published in 1999, let’s take a look at the summary stats for below and after 1999.

The mean annualized return is approximately 0.7% lower for the pre 1999 vs post 1999 data, as is the CAGR. The volatility is higher for the post 1999 data which leads to a difference in the Sharpe ratio.

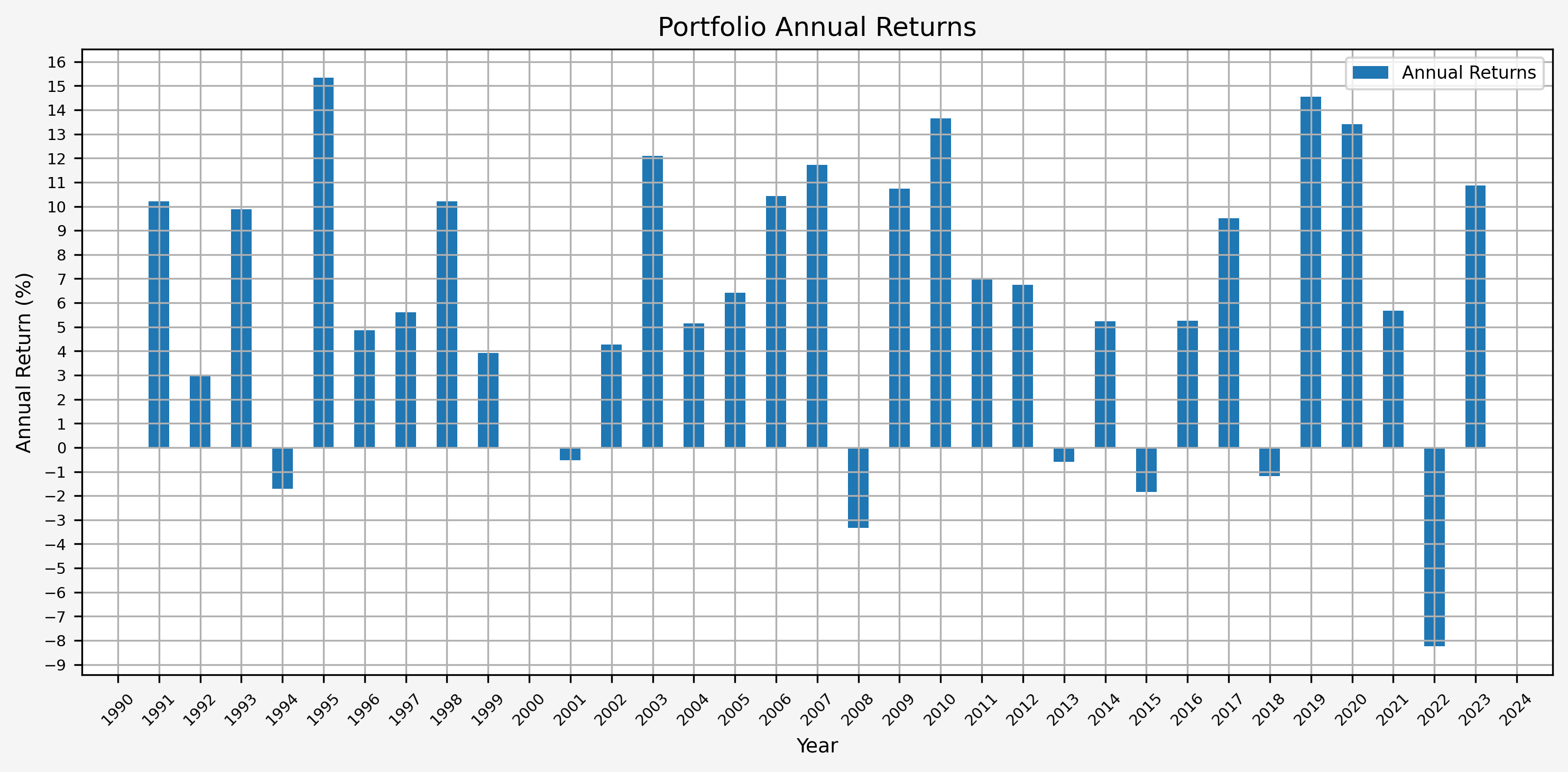

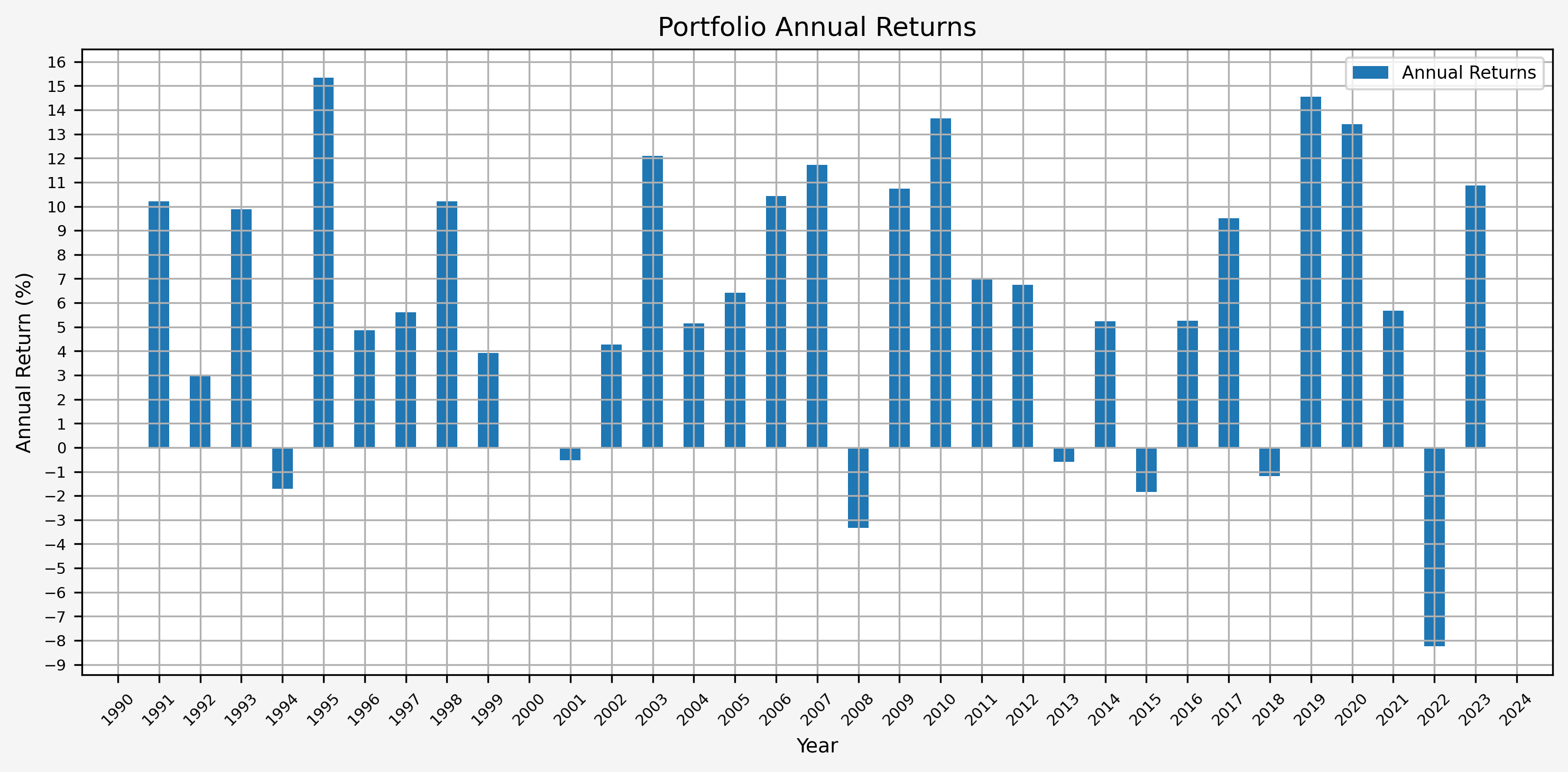

Here’s the annual returns:

Plots

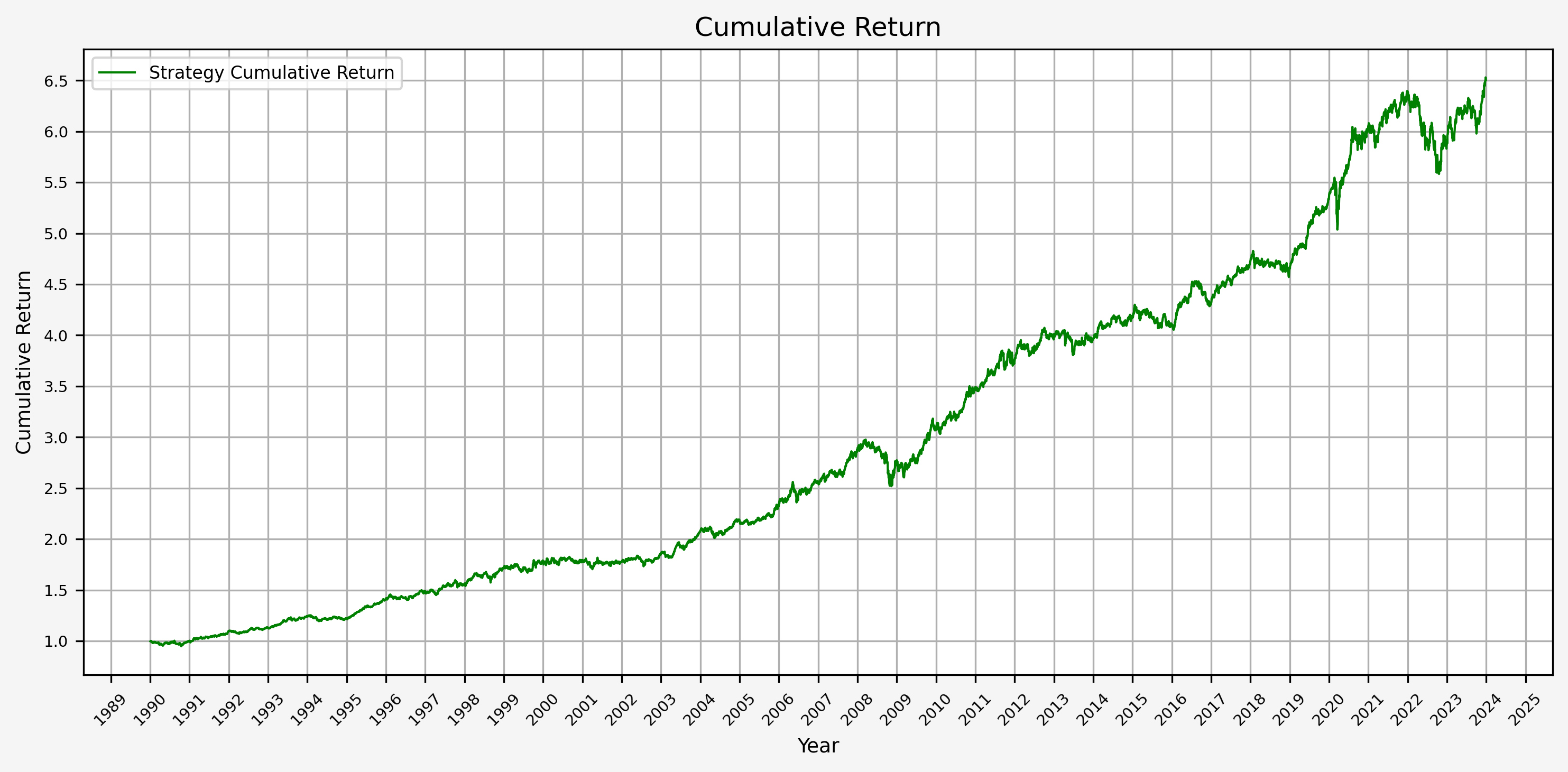

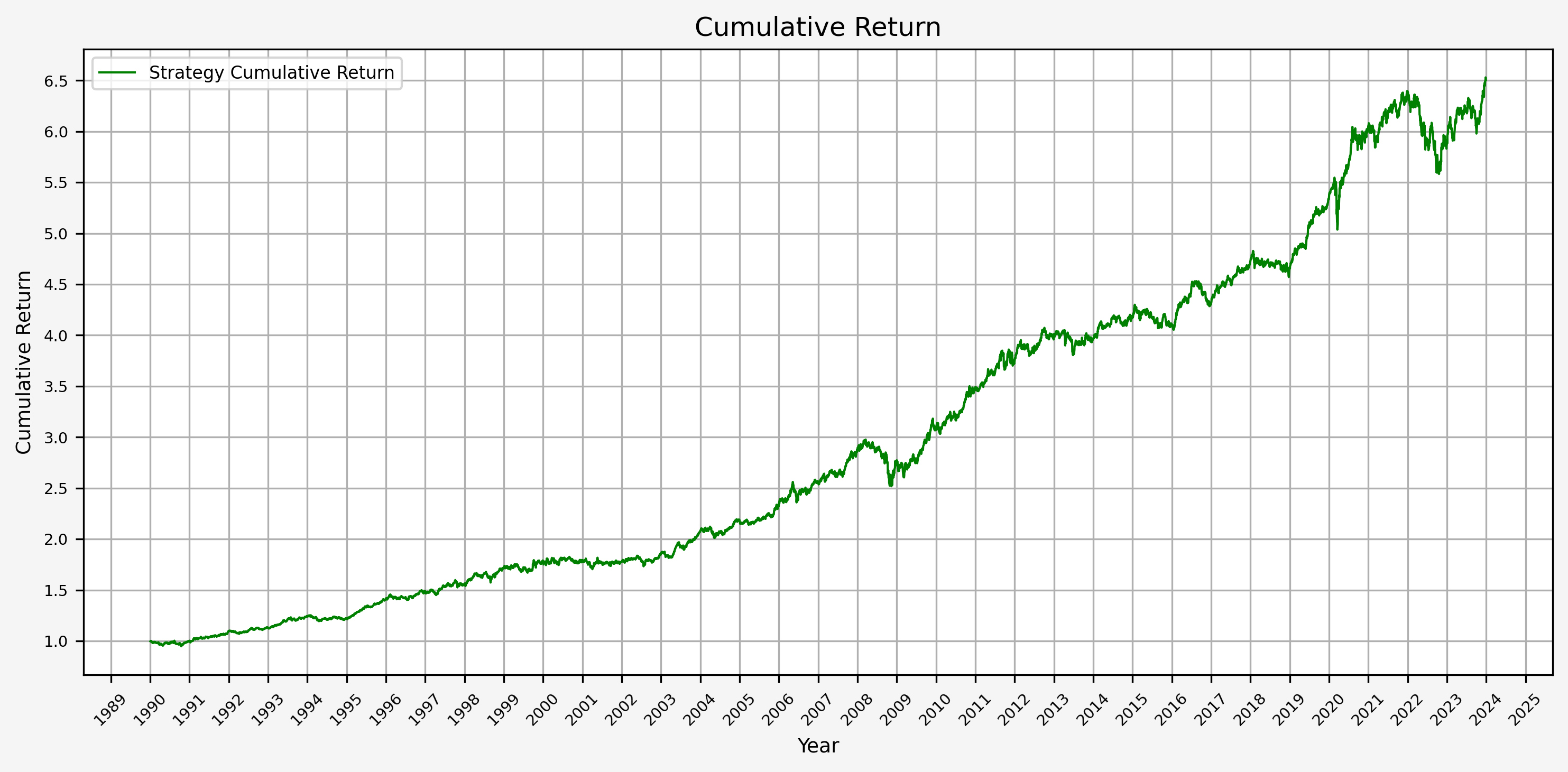

Here are several relevant plots:

- Cumulative Return

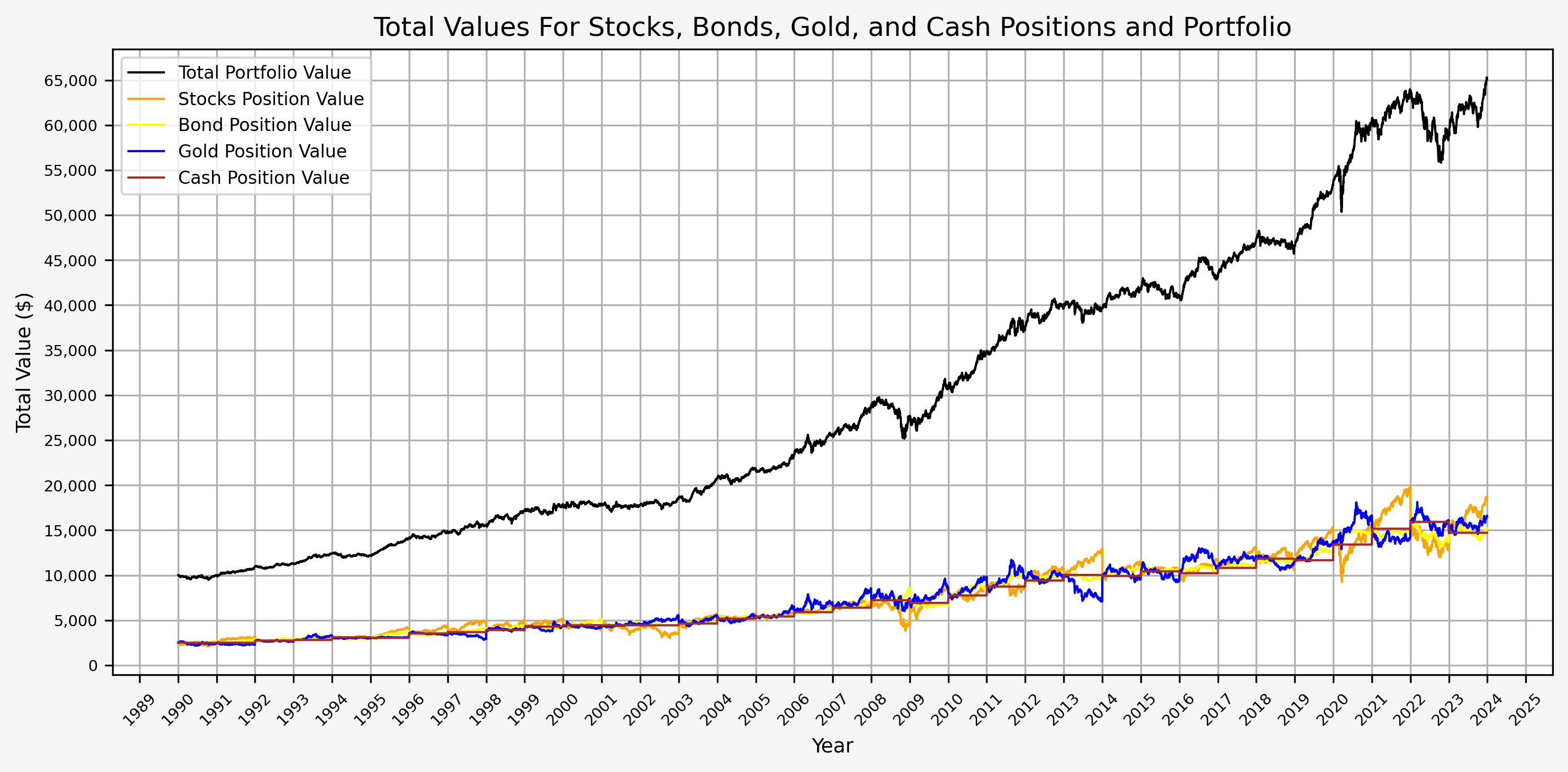

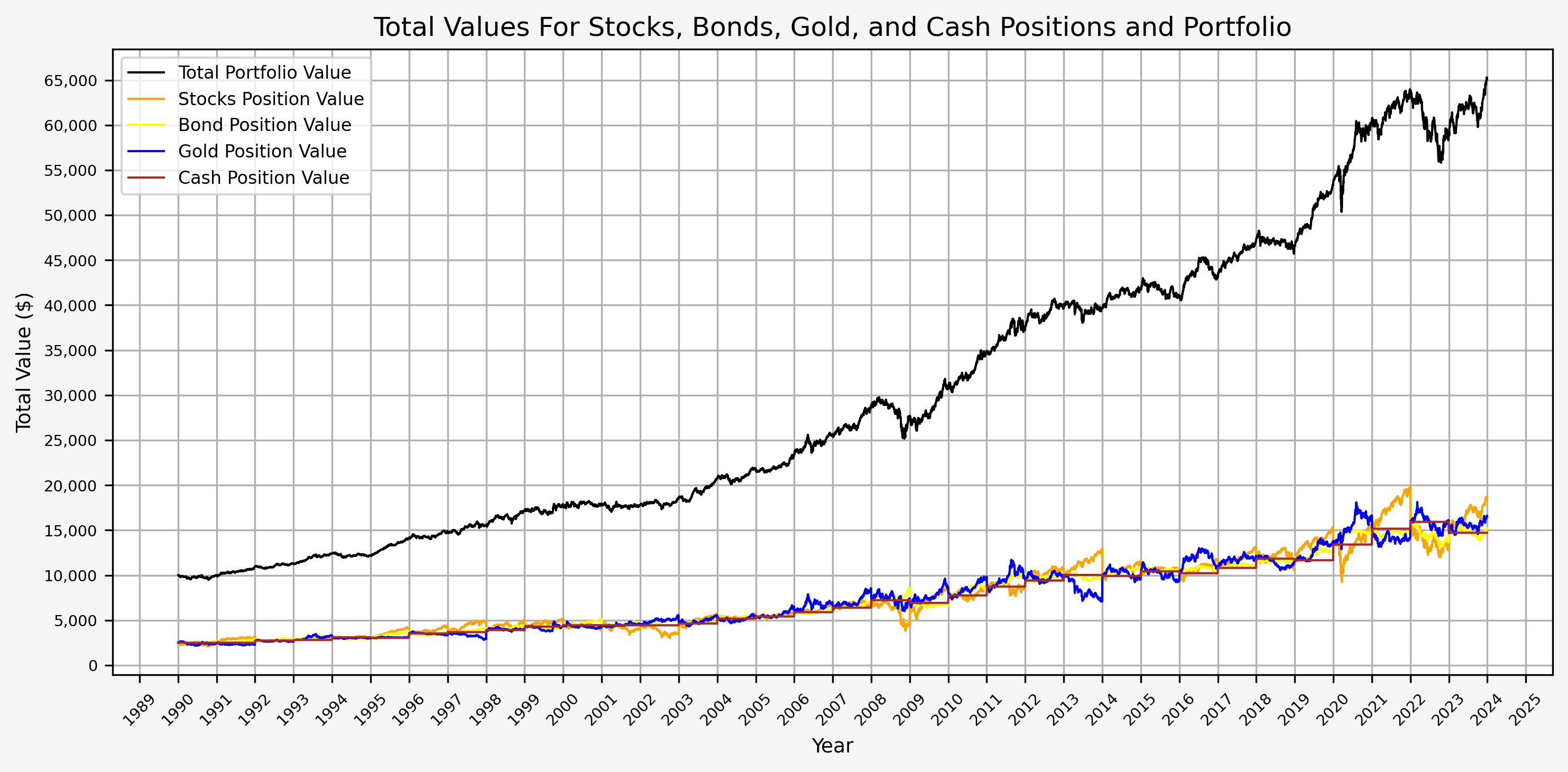

- Portfolio Values (Total, Stocks, Bonds, Gold, and Cash)

Here we can see the annual rebalancing taking effect with the values of the different asset classes. This can also be seen more clearly below.

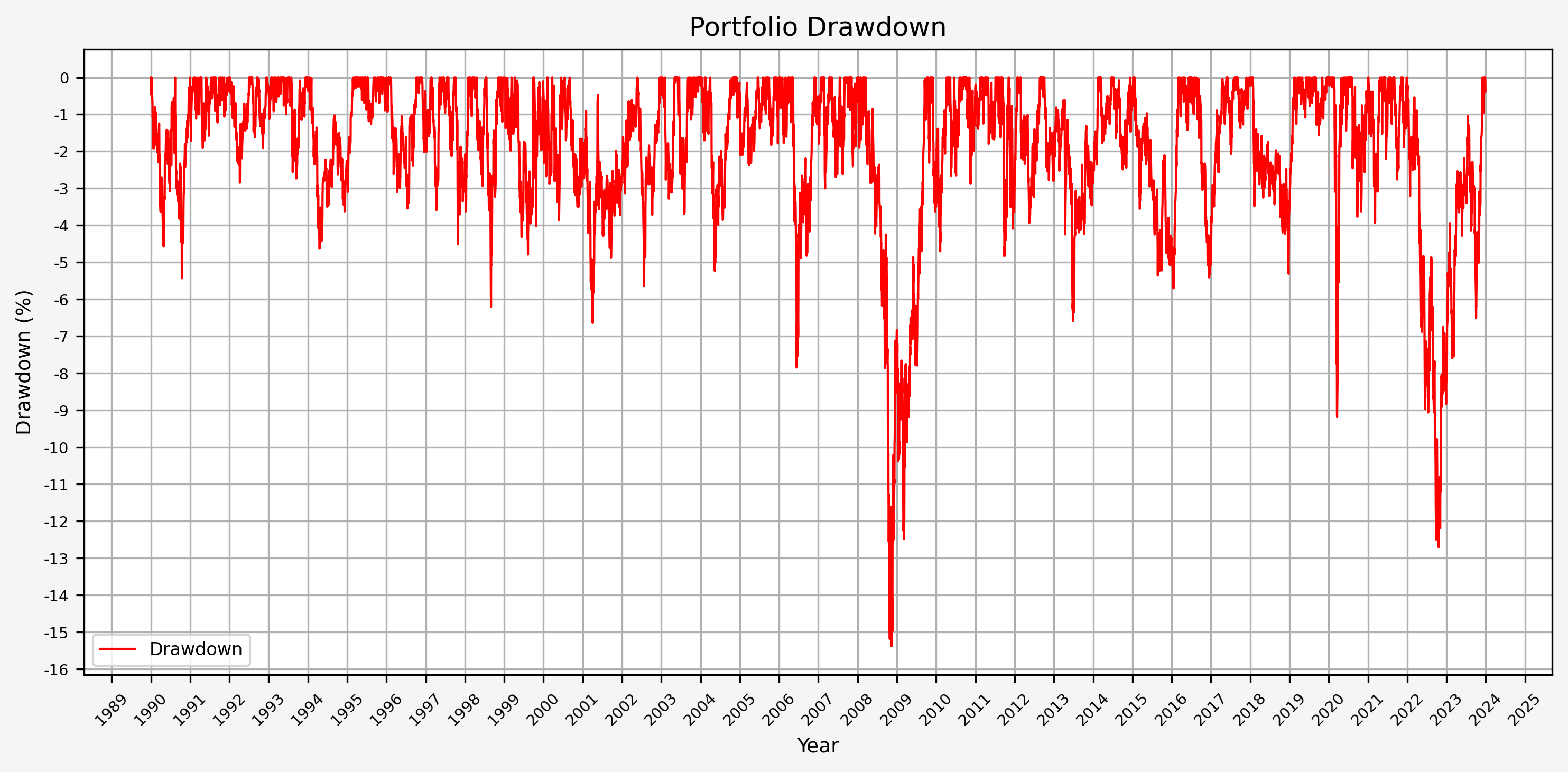

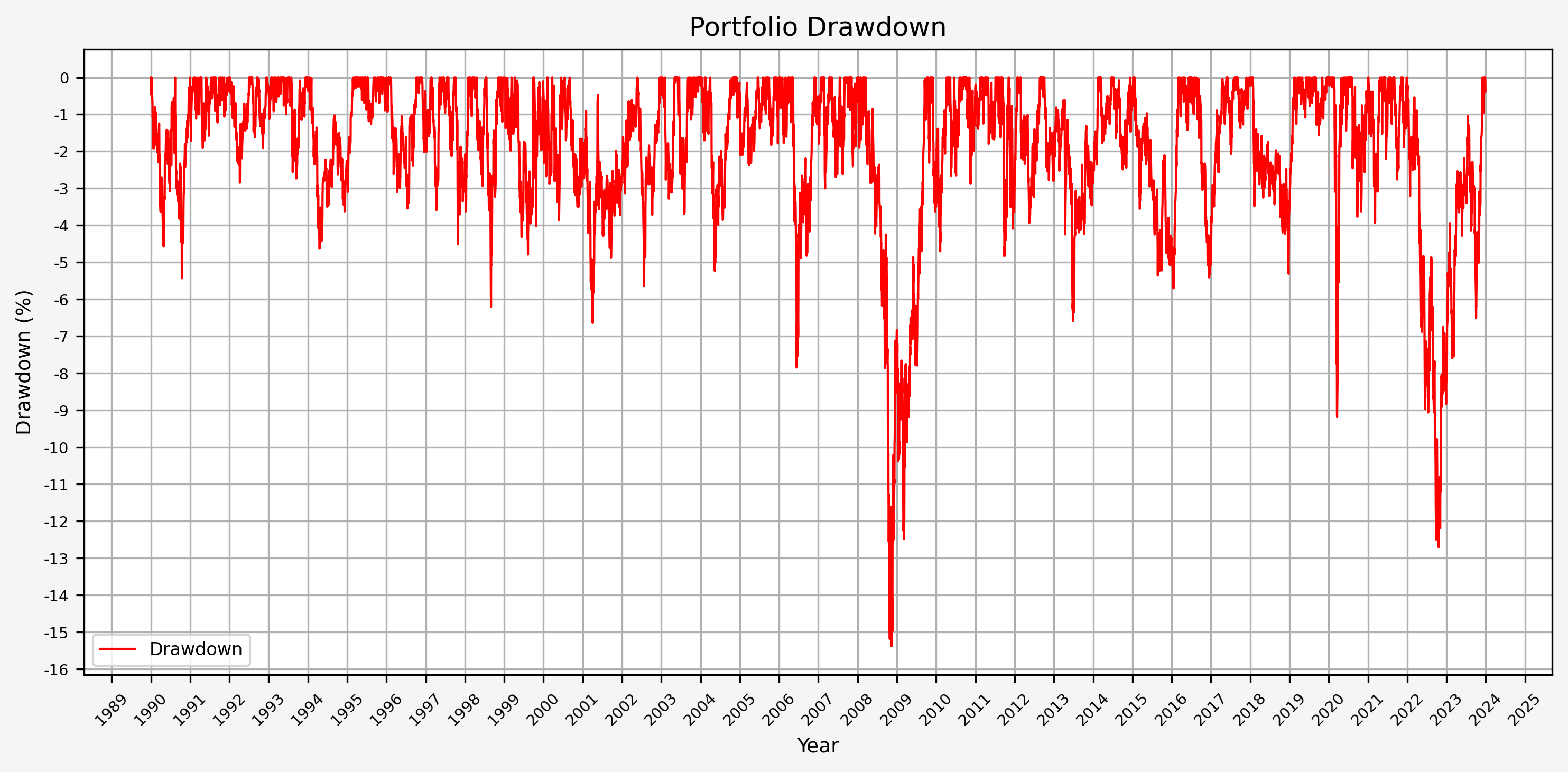

- Portfolio Drawdown

From this plot, we can see that the maximum drawdown came during the GFC; the drawdown during COVID was (interestingly) less than 10%.

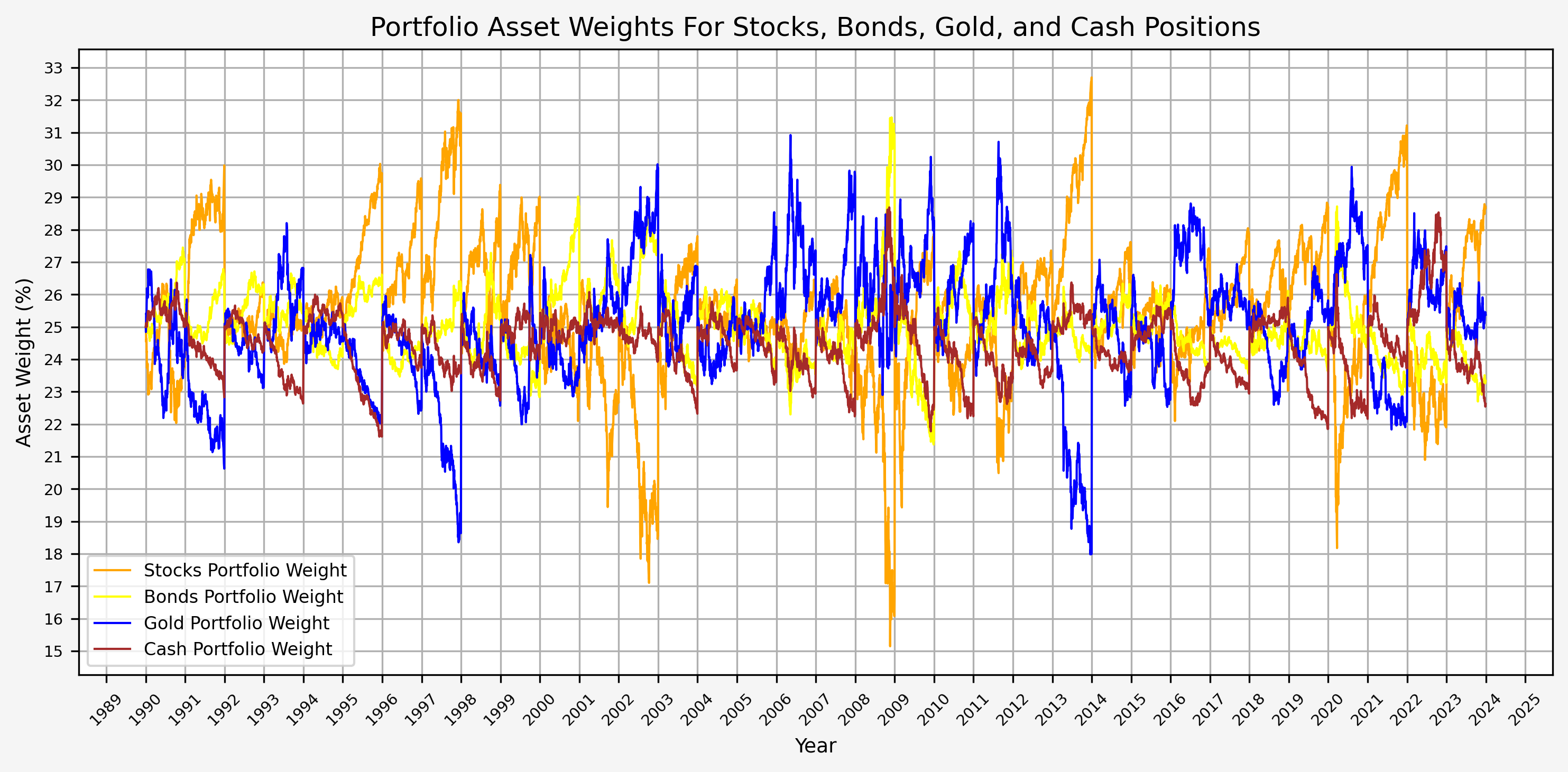

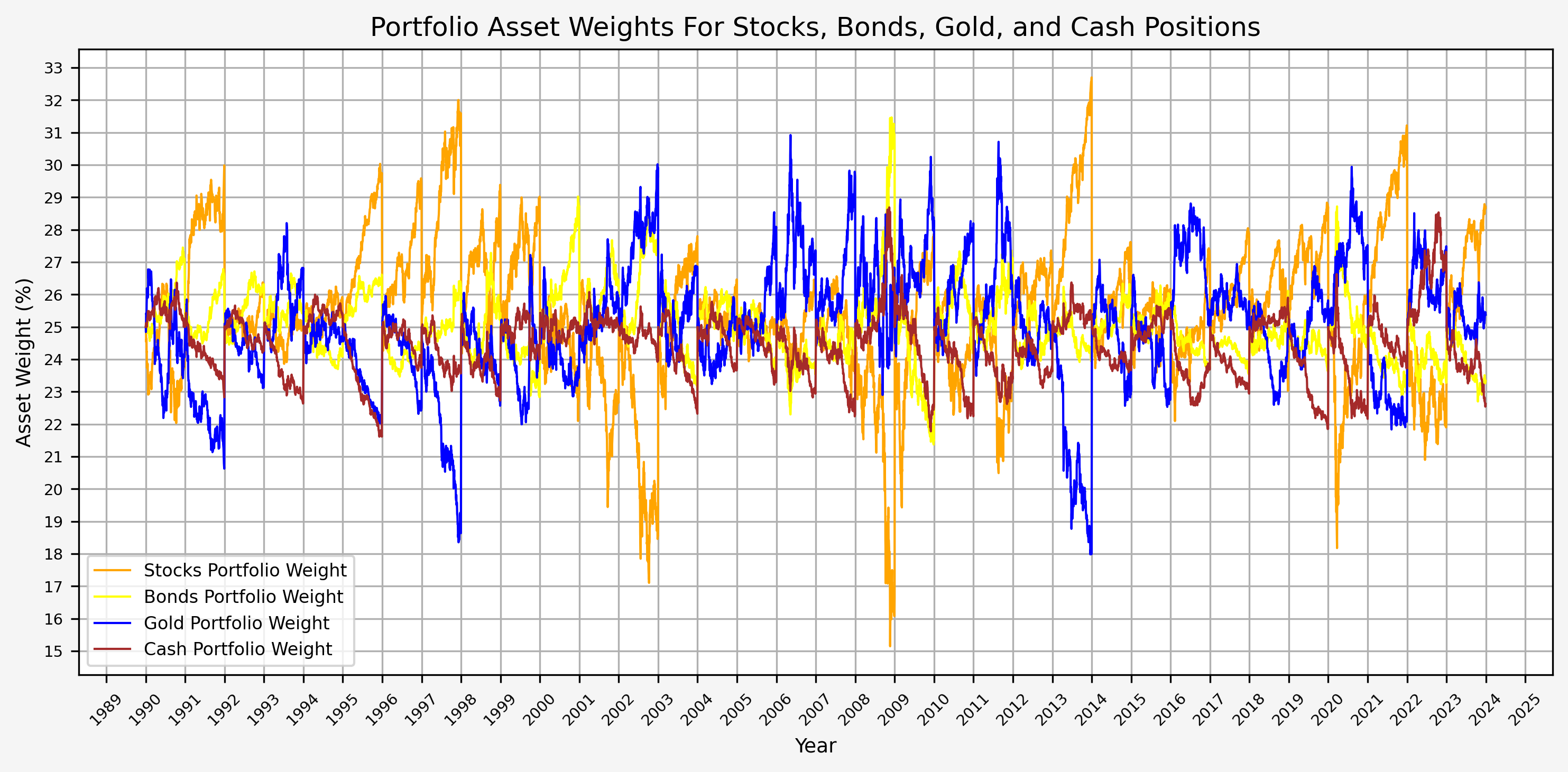

- Portfolio Asset Weights

The annual rebalancing appears to work effectively by selling assets that have increased in value and buying assets that have decreased in value over the previous year. Also note that there is only one instance when the weight of an asset fell to 15%. This occured for stocks during the GFC.

- Portfolio Annual Returns

It’s interesting to see that there really aren’t any significant up or down years. Instead, it’s a steady climb without much volatility.

Summary

Overall, this is an interesting case study and Browne’s idea behind the Permanent Portfolio is certainly compelling. There might be more investigation to be done with respect to the following:

- Investigate the extent to which the rebalancing date effects the portfolio performance

- Vary the weights of the asset classes to see if there is a meanful change in the results

- Experiment with leverage (i.e., simulating 1.2x leverage with a portfolio with weights of 30, 30, 30, 10 for stocks, bonds, gold, cash respectively.)

References

Fail-Safe Investing: Lifelong Financial Security in 30 Minutes, by Harry Browne

Code

The jupyter notebook with the functions and all other code is available here.